News

Secretary to Treasury advocates for pragmatic tax measures amid debt crisis

By Burnett Munthali

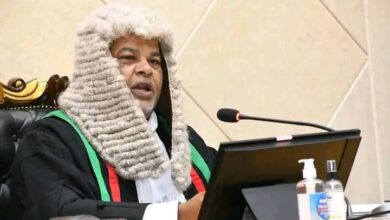

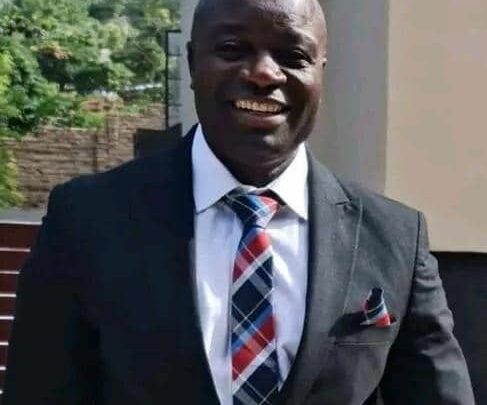

Speaking at a national conference on debt organized by the Malawi Economic Justice Network (Mejn) in Lilongwe today, Secretary to Treasury Betchani Tchereni addressed mounting concerns over Malawi’s debt burden, emphasizing the critical role of revenue generation through taxation.

Tchereni underscored that the solution to alleviating the country’s debt challenges lies primarily in increasing revenue rather than solely focusing on reducing expenditure. He expressed frustration over public opposition to beneficial tax measures that could significantly bolster government revenue.

One such example highlighted by Tchereni was a proposed tax on motorbikes, which he estimated could have potentially generated K172 billion annually. However, due to public outcry, the government was compelled to withdraw the proposal, illustrating the impact of political pressure on fiscal policies.

“The challenge is that political pressure often forces the government to abandon beneficial tax programs,” remarked Tchereni, emphasizing the detrimental effect of public resistance on crucial revenue-generating initiatives.

Furthermore, Tchereni referenced another instance involving a proposed vehicle tax that faced staunch opposition from car dealers who lobbied extensively at Capital Hill. This opposition further complicated efforts to implement measures aimed at augmenting government revenue streams.

In his address, Tchereni urged stakeholders to adopt a pragmatic approach towards fiscal policy, advocating for constructive dialogue and informed decision-making to navigate the complexities of fiscal management amidst economic challenges.

The conference convened by Mejn served as a platform for stakeholders to deliberate on strategies to address Malawi’s debt burden responsibly while ensuring sustainable economic growth. Tchereni’s remarks underscored the need for balanced fiscal policies that prioritize revenue generation while addressing public concerns and economic realities.

As Malawi continues to grapple with economic pressures exacerbated by its debt obligations, Tchereni’s call for pragmatic tax measures resonates as a pivotal step towards fostering fiscal stability and sustainable development in the country.

The outcomes of the conference are expected to inform future policy discussions and actions aimed at steering Malawi towards a more resilient economic trajectory in the face of ongoing fiscal challenges.