News

Govt U-turn on new fixed taxes for second hand vehicles

By Chisomo Phiri

Government has on Friday announced that it has resolved to reverse its decision to introduce the new system of clearing second hand motor vehicles, observing the figures considered to be new taxes for imported second hand vehicles were wrongly calculated by the Malawi Revenue Authority (MRA).

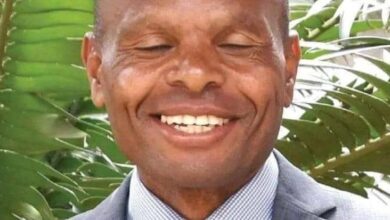

Minister of Finance Economic Affairs Sosten Gwengwe made the announcement at the end of the interface meeting he held with MRA officials and Car Dealers Association of Malawi in Lilongwe.

Gwengwe said, government would hold off on implementing the plans pending further consultations with traders of second-hand vehicles and other relevant stakeholders.

The minister further described as untrue

claims that government had adjusted upwards the duty on imported second hand vehicles and has since recalled the document as the system will not be implemented.

The decision came after the Human Rights Defender’s Coalition (HRDC) urged the government not to implement the taxes amid concerns that the proposal went against the norms and principles of taxation.

In a statement signed by HRDC chairperson Gift Trapence, the rights group accused the government of “arbitrarily assigning costs to goods” without “thoroughly analysing the Malawi Revenue Authority data in the Asycuda portal and the websites used by Malawians to import vehicles”.

Said HRDC in a statement: “Tax, as a principle, is a percentage of the actual value of the imported commodity. The approach being taken by the MRA using this new method is of determining tax value first in order to calculate the value of the imported goods.

“This is unlawful and it contradicts established principles of taxation and deviates from international law applicable to customs matters.”

Under the proposed system, which would have come into effect on August 1, the government would have been charged a fixed rate on imports of second-hand vehicles regardless of the price of the vehicle.